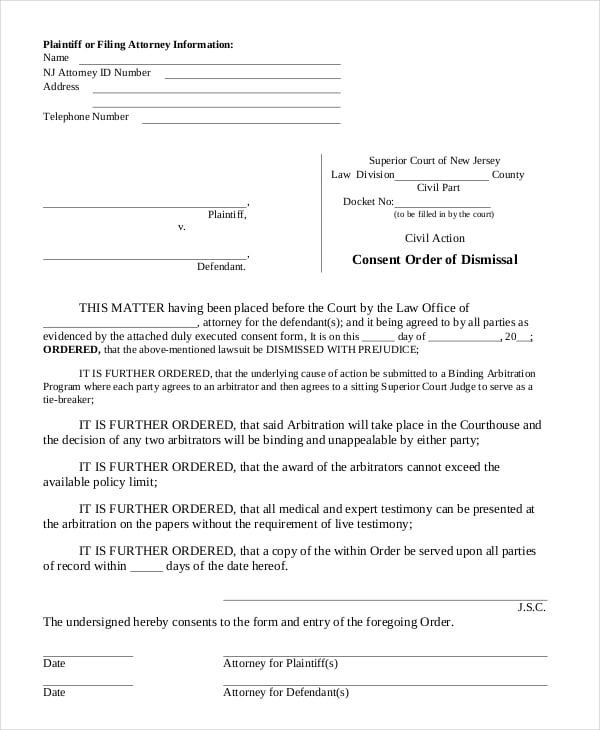

This result did not come as a surprise to many legal commentators, even those critical of the appeals decision. Reviewing the probing and extensive nature of Rakoff's questions regarding the proposed consent judgment and his subsequent decision refusing to approve it, a panel of the Second Circuit unanimously reversed his decision. Rakoff also held that when a public agency seeks court approval of such a settlement, "the court, and the public, need some knowledge of what the underlying facts are" otherwise, "the public is deprived of ever knowing the truth in a matter of obvious public importance." Employing this standard, Rakoff found he could not approve the settlement. Rakoff was apparently assessing the proposed consent decree under the "fair, reasonable, adequate and in the public interest" standard, "borrowed" in part from the standard used to review class action settlements as set forth in Federal Rule of Civil Procedure 23(e)(2). Rakoff found that before he could approve an administrative settlement, he was "required, even after giving substantial deference to the views of the administrative agency, to be satisfied that is not being used as a tool to enforce an agreement that is unfair, unreasonable, inadequate, or in contravention of the public interest."

#ORDER APPROVING JUDICIAL CONSENT FORM TRIAL#

Rakoff scheduled a hearing on the proposed consent judgment and directed the SEC and Citigroup to answer a number of questions, including why the court should impose judgment where the SEC alleged a serious securities fraud, but Citigroup did not admit wrongdoing whether there is an overriding public interest in determining whether the SEC's charges are true how the amount of the proposed judgment was determined (and why the proposed penalty was so much less than the penalty assessed in another large securities case) how the SEC planned to ensure compliance with the proposed injunction and why the penalty was to be paid by Citigroup and its shareholders instead of by the culpable individuals.Īfter consideration of the parties' written responses to his questions and a hearing on those questions and responses, Rakoff issued an opinion declining to approve the consent judgment and instead setting a trial date. Shortly thereafter, the SEC filed a proposed consent judgment whereby Citigroup, without admitting or denying wrongdoing, agreed to a permanent injunction barring it from violating certain sections of the Securities Act, disgorgement of $160 million, and payment of $30 million in prejudgment interest and $95 million in penalties. In 2011, the SEC filed a complaint against Citigroup, alleging both that the company negligently misrepresented its role and financial interest in structuring and marketing a billion-dollar fund, and that, as a result, Citigroup realized approximately $160 million in profits, while investors in the fund lost millions. Whether or not the Second Circuit's decision makes sense in the context of the facts and the parties before it, the highly deferential standard of district court review of such consent decrees articulated by the Second Circuit may prove to be overly restrictive when applied in other settings.

The Second Circuit found Judge Rakoff's approach to reviewing the proposed consent decree between the SEC and Citigroup was more probing than permitted and that he failed to provide the SEC the deference it was owed. In doing so, the Second Circuit seemed to articulate a narrow and highly deferential standard for district courts to follow when reviewing settlement agreements between government regulatory enforcement agencies and private parties. Citigroup Global Markets, 11-5227-cv (L) (2d Cir.

Securities and Exchange Commission (SEC) had brought against Citigroup Global Markets, Inc. Court of Appeals for the Second Circuit reversed Judge Jed Rakoff's order refusing to approve a proposed consent decree that would have settled a regulatory enforcement action the U.S.

0 kommentar(er)

0 kommentar(er)